SBI RTGS Form | SBI NEFT Form Download PDF format 2024 for Free. State bank of India rtgs/neft form. SBI bank RTGS timings at sbi.co.in, www.onlinesbi.sbi

SBI RTGS / NEFT Form

RTGS and NEFT systems are the latest online transaction method for banking services. The platforms come in handy for the Indian citizens who opt to register for this service. The RTGS services allows a transfer of funds from one account to the other. It has an official limit of Rs. 2 lakhs while the NEFT services user can transfer less than the Rs.2 lahks. the two are quick way of transferring funds from one account to the other, taking few minutes. The systems are secure and doesn’t need bank visits, the account holder requires login details to send and receive funds from the systems.

SBI Bank NEFT timings

There is specific transfer time set by the bank though they slightly vary from bank to bank. The system works from Monday to Friday 8:00 am to 7:00 pm and on Saturdays 10.00 am to 4:30 pm. However, the system doesn’t work on the 2nd and 4th Saturday.

Charges

charges vary according to time, after 3:30 PM the charges of Rs. 2-5 lakh charges are Rs.30+5 tax (35). Amounts above the Rs.5 lakh is charge Rs. 50+7 tax (57).

SBI Bank RTGS timings

The RTGS timings are from Monday to Friday 8am to 3:30pm and on Saturday 10am to 3:30pm excluding 2nd and 4th Saturday.

How to fill SBI RTGS/NEFT Form 2024

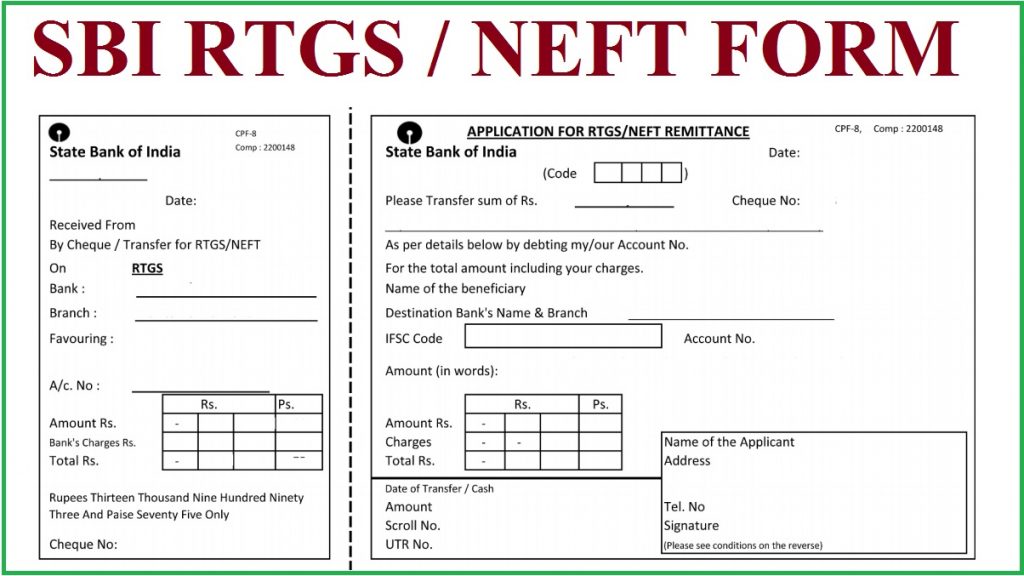

To apply for the RTGS services the user/applicant has to fill all their details for verification. The RTGS form has different sections specified on different information for user to read and understand. You can visit the bank to receive the form or visit the SBI website page.

- On the RTGS form fill in details as request, the form is divide in to two sections. The right section is for the beneficiary and remitter while the second section is the customers copy.

- Enter all details such as sender account number, beneficiary account details, the beneficiary bank IFSC code and the total amount to transfer.

- Recheck the details then the bank will branch use only section note this part is left for the bank official only. After completing the transaction, you will receive a transaction id.

- The RTGS system will only transfer amounts higher than Rs.2 lakhs

SBI RTGS/NEFT form PDF 2024 Free Download

Sir what are the drawback of Neft. I mean debiting account is through cheque then there is a trail of transactions isn’t it and it is also happening electronically.

Sir what are the drawbacks of NEFT/RTGS. I mean debiting the account through cheque leaves a trail as it is done electronically isn’t it. If I am wrong kindly let me know.