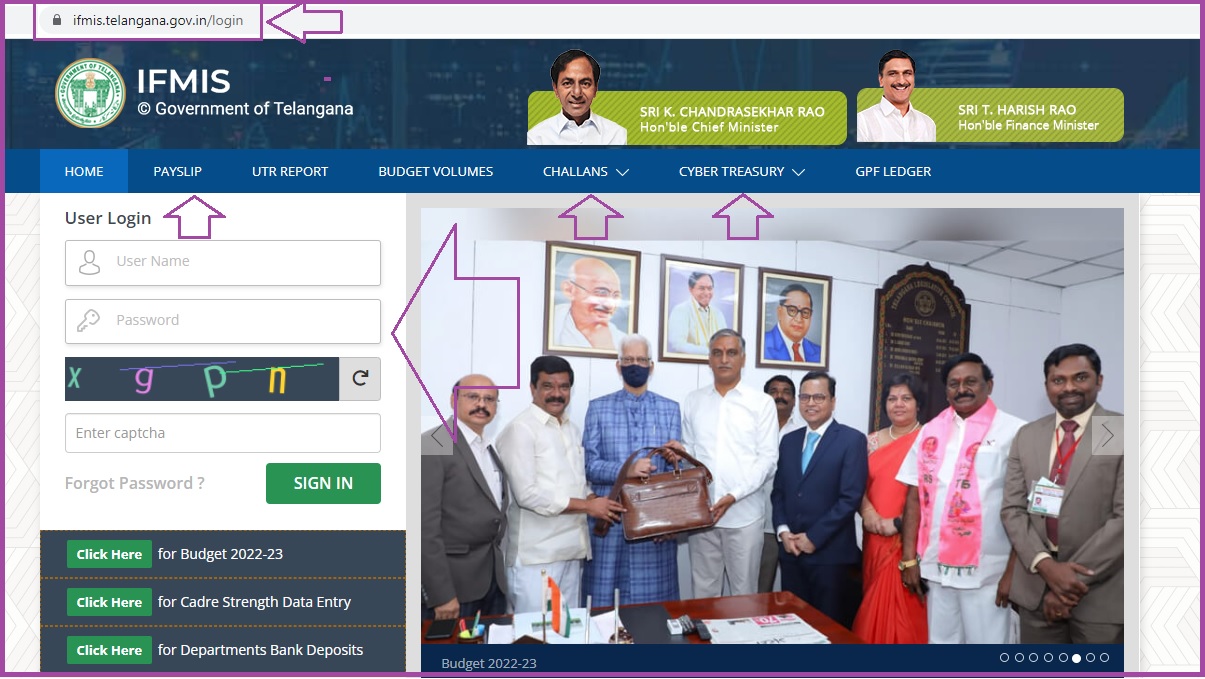

Telangana DDOREQ Cyber Treasury – TS DDO Request. Generate DDO Request Salary Bills 2022 using DDO Claims Code at https://ifmis.telangana.gov.in/login (or) treasury.telangana.gov.in/ddoreq/

TS DDOREQ

As earlier stated, Telangana is one of the states using DDO request. It is possible all thanks to their website. That site is https://treasury.telangana.gov.in/ddoreq/. If one visits it, he or she will be in a position to either update or submit financial transactions’ details. The people of Telangana are happy because of its existence.

They not only access it from the comfort of their homes but also have a way to ensure that they get their salaries deposited into their bank accounts directly. In addition to that, the safety, accuracy as well as the security is a guarantee. Therefore, only the authorized people can access the confidential information that you submit.

Ifmis.telangana.gov.in/login

DDO Request Login for Telangana Treasury – How to Prepare Telangana Salary Bills

- In the case of the Telangana treasury, you will visit this link https://treasury.telangana.gov.in/ddoreq/

- At the DDO Claims login box, enter both the DDO code and the respective password.

- A successful login takes you to a new page. Click the ‘PAY BILLS’ module on a menu on the left side

- Select the bill id and enter both the year and the month

- Tick the increment box along the row of a candidate who should receive a salary increase.

- Tap on the ‘Next’ button which will trigger the completion of the pay bill preparation process.

- Select the specific form number as well as the head of the account. Then, click the ‘Submit’ button to mark the end of the process.

How to Generate DDO Request Salary Bills using DDO Claims Code

- As promised earlier, the process of the generation of the request salary bills utilizing the ddo claims code is discussed below. They follow once you finish preparing the salary bill. Continue reading to find out more about it.

- Click the Submit button found at the bottom of the page.

- Check the TBR Number and jolt it down

- Go back to the ‘PAY BILLS’ module and select the ‘TBR Beneficiary entry of “year”’. The move will enable you to link the number mentioned above to the employees Bank Beneficially account. You merely select the TBR (To Be Real) number from the drop-down list.

- This screen displays all the billed employees. Details include the TID, employee code, beneficiary name, IFSC code, bank account number, TBR number and the net amount. Click on the ‘Submit’ button.

- For a TBR Beneficiary Report, click on the ‘PAY BILLS’ module and select the ‘TBR Beneficiary Report’. Then, key in the TBR number. Click the print button for a print out of the report.

- Visit the ‘Reports’ module to print the Form-47 as well as the Bill Schedules. You will click the Form-47 Generation and bill schedule for each case, respectively.

- Go to the Pay bill details module for the salary bill.

When you follow the instructions to the letter, you will be one step from completing the exercise. All you will have to do is to gather the Form-47, Bills, TBR Beneficiary Report and Bill Schedules printouts. Then, submit the 101 and Paper token forms together with the printouts to the Treasury office.